Rockdown is accelerating the digitalization of finance -the use of the Fintech app is increased by 35-85%[Investigation Report] | Bridge (Bridge) Technology & Startup Information

Pickup: Banking on Mobile Up 35-85% Thanks to Coronavirus (After 1 Trillion App Opens in 2019)

News Summery: 2019 was a fruitful year for banking and Fintech apps.Many users began to use the mobile finance app, and more apps have grown rapidly.And in 2020, the fortunes of the unfortunate, but may be able to expect further growth due to the effects of self -restraint and rockdown that starts on the new colon virus.

According to a joint research report between Liftoff and App Annie, the number of consumers from around the world in 2019 has increased the number of finance apps twice from 2017 and reached an estimate of 1 trillion.1 depending on the area.Although the degree is different from about three to four times, it can be seen that more consumers are starting to use finance apps consistently throughout the world.

According to the influence of the new colon virus, Liftoff's representative responded to Forbes as follows.

Popular point: If there was no pandemic this time, how did the world's FinTech market grow?It is natural to expect that the use of finance apps has increased when data in the past year has increased.

As mentioned earlier, the number of sessions in the world's finance app (the number of apps opened) reached 1 trillion in 2019.If you look at the numbers by each country, you can see that China is the best.After the second place, it continues to India, Brazil and the United States.

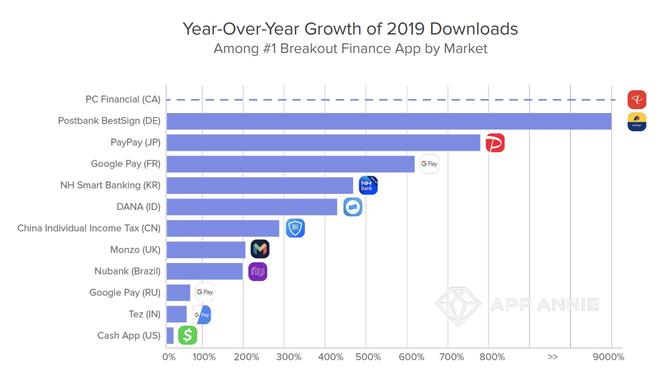

However, if you introduce differences in growth by region, the growth of India and Indonesia is particularly tremendous, both of which exceed 100%.In developed countries, France is 15%, Germany and Japan have grown 30%.In the Japanese market, mobile payment PayPay is large, and the number of downloads of the app seems to have been ranked third in the world in 2019.

From the above data, we can anticipate that the demand for finance apps around the world is growing steadily, regardless of the pandemic.

Is the pandemic out or bad?

Self -quarantine, request for self -restraint, or rockdowns have stopped visiting stores and banks.Under such circumstances, the use of mobile financial apps that can access payments and banking services is an inevitable phenomenon.

E -commerce sites are used for shopping and raising ingredients during the self -restraint period, so the use of mobile payment apps is expected to increase.When a worker or business person wants to cover the decline in revenue and income, he may use a banking app without going to a branch.

As long as the current situation continues, it is possible to speculate that the use of mobile financial apps will increase, while the use of existing offline banks will increase.

However, it cannot be decided that this situation has a positive effect on the growth of the FinTech app.The reason is due to the downturn of the economic economic downturn and the decline in consumption.

Currently, many consumers have to refrain from working at the same time, and have been cut off.Some governments have promised some government support, but in this situation there will be almost no people who want to accelerate consumption more than usual.

If consumption is sluggish, the number of payments itself will decrease, so it is natural that the frequency of use will decrease, but it will be a mobile app.If the economy is sluggish, there is a risk of further decreasing expenditures, and the use of apps and the like may be a phenomenon.

Time will prove whether this pandemic can make a great profit to FinTech, but considering the negative scenario, it is not possible to determine which time is not the actual value.But at least, from the perspective of shifting from existing traditional finance, it seems to be positive.

Bridge Members

BRIDGEでは会員制度「Bridge Members」を運営しています。会員向けコミュニティ「BRIDGE Tokyo」ではテックニュースやトレンド情報のまとめ、Discord、イベントなどを通じて、スタートアップと読者のみなさんが繋がる場所を提供いたします。登録は無料です。無料メンバー登録